Discover how the Internet of Things (IoT) transforms the financial sector, opening doors to efficient transactions and enhanced security. Immerse yourself in this groundbreaking revolution today!

Industries are transforming client interaction with the Internet of Things (IoT). This technology is applied in several sectors, including retail, agriculture, transportation, and healthcare, and is gradually adopted by the banking sector.

IoT in finance helps develop new services and products, enhance security measures, simplify many processes, and better understand customer behavior. This article unveils how IoT can leverage its potential to transform the financial services industry.

Why You Need IoT in Your Financial Business

IoT provides a variety of new possibilities for the banking industry and has many applications. Let’s explore them in more detail:

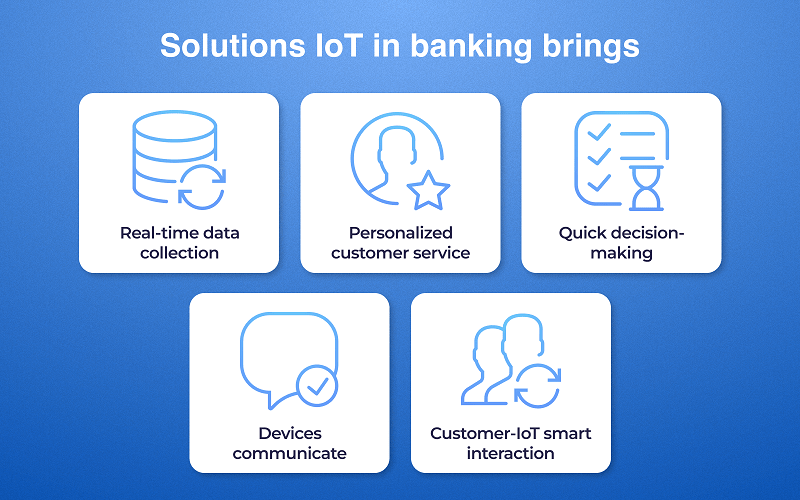

#1. Collecting real-time data

IoT technology provides access to real-time information for assets like cars and homes, which can offer benefits for insurance.

For example, the car insurance policy specifies procedures for submitting claims based on data collected from sensors in different locations, such as the car and residence.

#2. Customized service

The Internet of Things integration in banking has gained popularity due to its ability to enhance customer service.

IoT technology enables real-time monitoring and control of customer transactions, providing timely notifications and better tracking of customer activities.

Furthermore, it can offer individualized services like personalized loan options and customized credit card propositions.

#3. Enhancing decision-making

Information collected by IoT devices can offer banks valuable data about their clients. This data helps to improve decision-making and customer service and enhance product strategies.

For instance, banks can evaluate potential credit risk for each client based on their social media data and buying preferences.

#4. Communication between various devices

IoT enables you to pay without cash using sensors and software. This solution could become very popular. For example, the supermarket utilizes a sensor to identify the items within a customer’s cart and determine the total cost.

The sensor is connected to their mobile wallet, allowing for streamlined payment processing. The capabilities of the IoT in the banking and finance sectors are not fully disclosed at this time. However, experts predict that the IoT will notably influence banking strategies.

IoT Applications in the Financial Sector

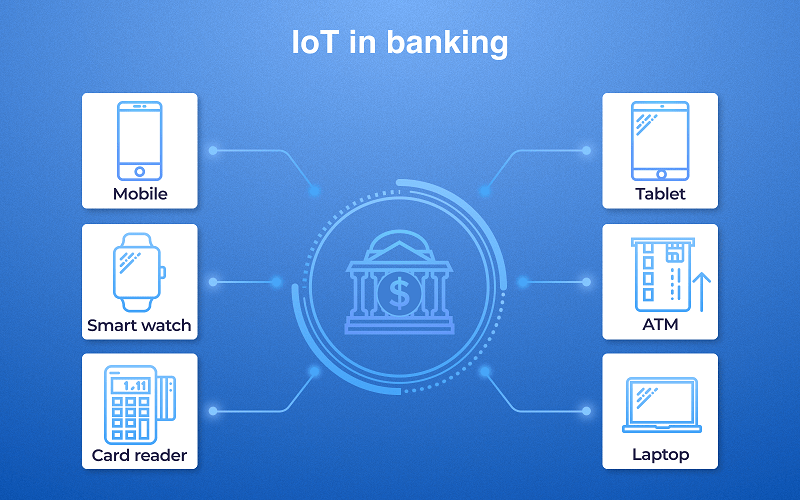

Banks around the world are using IoT capabilities to attract more customers.

From mobile banking apps, which almost all global banks now use as apps that help track customer preferences, to various sensors that allow financial institutions to collect information from their branches to sensors in wearable devices that can track how customers use banking products.

Let’s take a look at the main applications of IoT in banking:

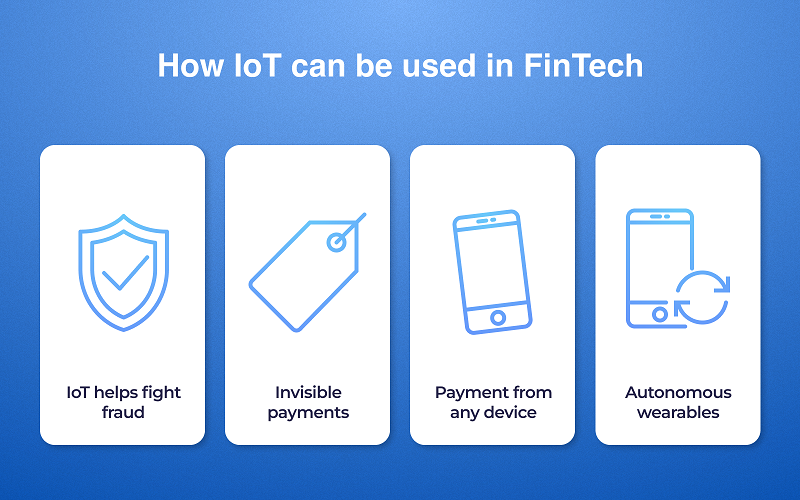

#1. IoT vs. fraud

Integrating the Internet of Things (IoT) in the banking industry brings technological advancements and tools to combat fraud. Banks can detect and prevent fraudulent activity faster using sensors, connected devices, and data analytics.

Biometric authentication is an example of how IoT is implemented in the banking industry. Banks can utilize facial recognition technology to authenticate a customer’s identity and mitigate identity theft.

In addition, IoT sensor networks can be used by banks to identify possible fraudulent transactions in real-time.

#2. Invisible payments

Invisible payments allow customers to make transactions without any physical or digital interaction. For example, the Internet of Things connects devices to financial institutions, such as credit and debit cards, mobile phones, and wearable devices.

This technology allows for contactless payment options for customers, in-person or online, without requiring physical interaction with a machine or card.

As a result, technology provides advantages such as improved customer convenience and security and cost efficiency for financial institutions.

#3. Accessible payments

Another notable outcome of IoT in finance is the convenience of making payments anytime and anywhere. In addition, the new system enables payment without a client’s physical presence at a financial institution.

IoT technology allows for convenient mobile banking solutions, allowing customers to make payments remotely through various devices. The payment process has been improved for greater convenience and flexibility.

Digital payment methods offer benefits such as decreased reliance on cash transactions and cost savings for financial institutions through reduced physical currency management.

#4. Autonomous wearables

Wearable devices are becoming more common in financial operations. As a result, banks are exploring options to enhance the accessibility and security of financial information through devices, to simplify the process for customers.

For example, a new method has been developed to access bank accounts, credit cards, etc., without requiring login credentials or physical devices.

There is potential for numerous use cases in IoT banking. However, it’s important to note that hardware requires suitable software to operate effectively.

Main Challenges You May Face Adopting IoT

The integration of IoT in banking has garnered attention for its potential to enhance customer experience, optimize efficiency, and develop innovative solutions. However, the cost of building a FinTech app with IoT implementation may be higher.

Moreover, addressing security and privacy concerns is crucial when implementing new technology. The banking sector is still sensitive to the risks and challenges of IoT. Introducing an array of sensors and devices may create new attack vectors and vulnerability areas within banking networks.

Security issues and device authentication are among the primary areas to be addressed to ensure a secure network for customers. Furthermore, there needs to be more trust between device makers, software developers, and consumers.

In addition to security concerns, privacy-related factors are another obstacle for financial institutions. With billions of connected devices these days, it’s vital that banks address legal and regulatory requirements when leveraging IoT technology or third-party apps for customer data collection.

Moreover, due to the ever-changing nature of technology, there is a need for a continuous process that allows testing efforts to mitigate new threats or keep up with recent trends and possibilities regarding IoT devices used by banks’ customers.

Continuous monitoring is also crucial for evaluating if the transactions made at specific points-of-sale terminals are suspicious or could be linked to an unauthorized access point within a particular bank’s network.

Considering all these elements can help banks ensure better cyber security strategies while allowing them to leverage IoT technology successfully.

Wrapping Up

IoT technology in the financial sector enhances client experiences and heightened security protocols. When implementing the Internet of Things, banks must consider various factors to maintain a secure and safe environment for their clients.

The FinTech industry shows considerable potential for IoT, suggesting a promising future. However, planning and executing it thoroughly to prevent potential issues or errors is advisable to ensure a successful implementation process.

Nevertheless, financial organizations are increasingly adopting IoT technologies in their business operations despite the potential drawbacks.

Author’s bio:

Yuliya Melnik is a technical writer at Cleveroad. It is a web and mobile app development company in Ukraine. She is passionate about innovative technologies that improve the world and loves creating content that evokes vivid emotions.